Quarter in Review: What Worked Beneath the Surface

The first quarter of the year kicked off with optimism—by mid-February, the S&P 500 had surged 5%. But sentiment flipped quickly, and the index ended the quarter down nearly 5%. That was before the surprise tariff announcements stirred even more uncertainty.

So, what happened?

The group of tech titans often referred to as the "Magnificent 7" took a sharp turn lower. These former market leaders dropped an average of 15%, dragging down the broader index with them. But focusing solely on these big names risks missing the bigger picture.

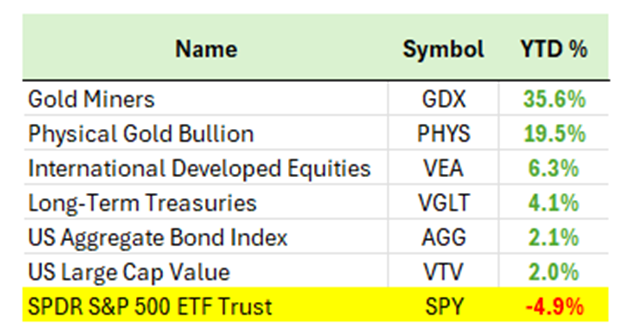

Source: Ycharts – Price return as of 3/31/2025 – “ Gold Miners”: VanEck Gold Miners ETF (GDX) , “Physical Gold Bullion”: Sprott Physical Gold Trust (PHYS), “International Developed Equities”: Vanguard FTSE Developed Market ETF (VEA), “Long-Term Treasuries”: Vanguard Long-Term Treasury Index (VGLT), “US Aggregate Bond Index”: iShares Core US Aggregate Bond ETF (AGG), “US Large Cap Value”: Vanguard Value Index ETF (VTV)

While the headlines revolved around the Mag 7, the other 493 companies in the S&P 500 were essentially flat for the quarter. That’s not bad, considering the dramatic narratives in the news. And for those who were diversified—with exposure to gold, international markets, or value stocks—there were bright spots.

In fact, one of the biggest stories that didn’t make headlines was overseas.

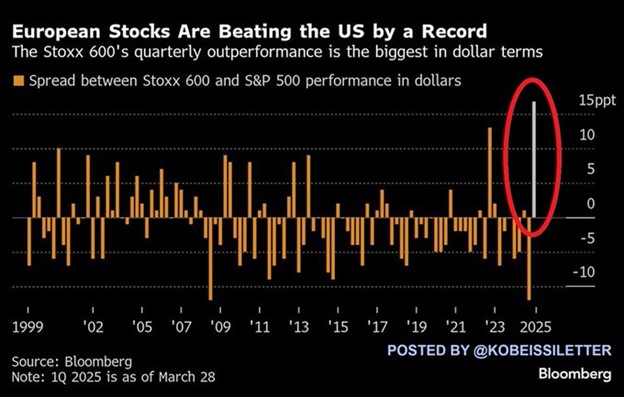

Source: Bloomberg / Kobeissi Letter

European markets outpaced the U.S. by nearly 17%—marking one of the strongest quarterly leads on record. Double-digit outperformance like this has only happened twice since 2000. A big driver? Germany’s announcement of a major fiscal stimulus package, aimed at boosting economic growth. It’s a reminder that while U.S. markets often take the spotlight, global diversification can open up powerful opportunities.

Back at home, there were other signs of strength flying under the radar. Inflation data surprised to the downside. Prices are easing across categories. Even the cost of eggs—once the poster child for inflation—has dropped more than 60% from its peak. Consumers remain surprisingly resilient, particularly higher earners who drive a significant share of economic activity. The labor market, while not booming, is stable. Wages are still growing, and household debt remains manageable.

And perhaps most importantly for long-term investors, corporate earnings continue to look solid. Margins remain high, and profits are rising at a pace better than much of the post-2008 era. While policy headlines—like tariffs—can create temporary headwinds, strong earnings provide a cushion. And if we get future tailwinds like interest rate cuts or tax reforms, corporate profits could gain even more momentum.

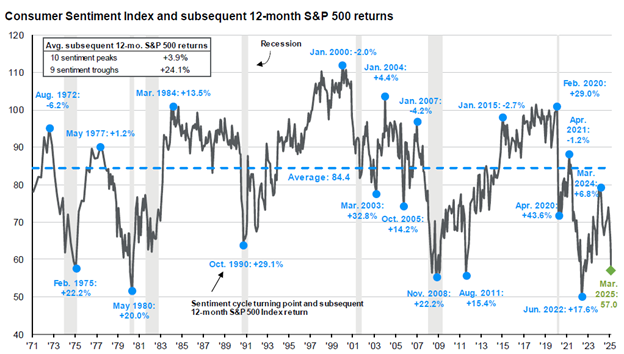

Source: Bespoke Investment Group

So yes, markets were rocky. But corrections are a normal part of investing. Since 1950, we’ve seen 5% pullbacks about three times per year, 10% drops every 1–2 years, and full-blown bear markets about once every six years. Volatility isn’t the enemy—it’s the price of admission for long-term growth.

Our job isn’t to predict headlines. It’s to stay diversified, stay disciplined, and help you navigate through periods of uncertainty with a clear, long-term plan.