E-Magazine January 2024

From everyone at Barry Investment Advisors, Happy New Year! We deeply appreciate your trust throughout 2023, a year that continued to challenge and reshape the capital markets. Our commitment to supporting your financial journey remains steadfast as we embark on 2024. Please remember, our team is always here to assist with any queries you may have about the markets, your financial plan, or your tailored wealth management strategy.

Looking forward to the New Year, we are excited to share a comprehensive '2023 Year in Review' by Visual Capitalist as part of their 2024 Global Forecast Series. This analysis offers a retrospective view of the past year's economic trends and events, providing valuable context as we navigate the opportunities and challenges ahead in 2024.

Please click on the link below to view this analysis.

Chart of the Month

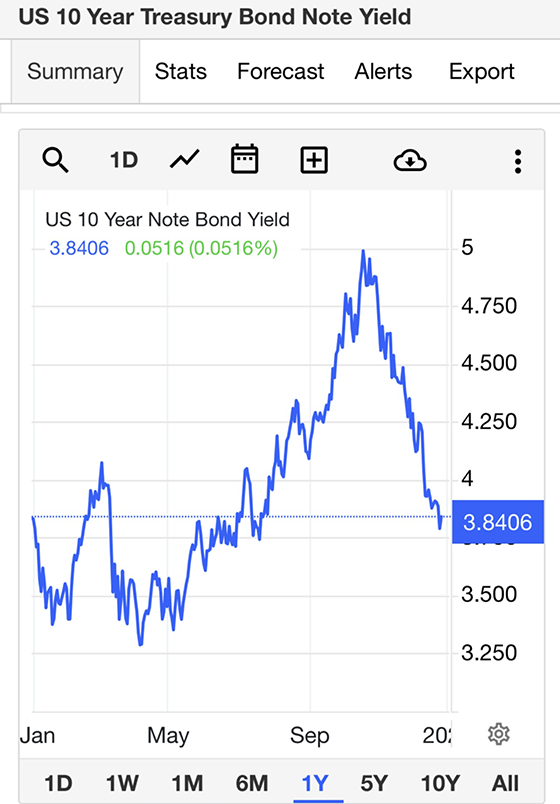

In the recent U.S. financial landscape, the yield on the 10-year Treasury note hovered around 3.8%, aligning closely with its five-month low of 3.78% observed last Wednesday. This trend reflects increasing market anticipation of potential rate reductions by the Federal Reserve. Recent labor market data, including a rise in initial unemployment claims beyond forecasts and continuing claims reaching a one-month peak, suggest a slight weakening in the U.S. job sector. According to Fed funds futures, there's approximately a 90% likelihood that the Fed will initiate a rate hike by the first quarter of 2024, which has escalated the demand for Treasury bonds of various durations.

This shift in market sentiment, as highlighted by a chart from Trading Economics, is a significant departure from the Federal Reserve's previous stance on maintaining higher interest rates for an extended period. The result has been a dramatic drop in the yield on the 10-year note, decreasing by 120 basis points since its peak at 5% in October, a 16-year high. This decrease has fueled a robust rally in fixed-income assets, leading key bond indices to experience some of their strongest performances since 1990.

Investing Wisdom

“What the wise do in the beginning, fools do in the end.”

- Undefined

The Lighter Side of Investing

Employee Happenings

It was another busy month for the Barry Team!

- Kate attended the MarketCounsel Summit in Las Vegas. She was able to network and learn more about the latest compliance rules and regulations for the new year.

- Liz, Katherine, Beth and Julia attended the Boston Women's Networking event in the Seaport District of Boston. They had great time meeting other women and seeing some familiar faces in the industry.

- Liz and Whitney attended Fidelity's Holiday Party in Boston. Their party is always a team favorite!

- The whole team had a wonderful time getting in the holiday spirit on the Newport Dinner Train. The theme of the night was a Murder Mystery and as it turns out, our very own Lauren Lennahan was proven guilty!

- Last but certainly not least; Maya, Blair, Harper, Taco and Olive also enjoyed sharing in the holiday fun! We love our fur babies amongst the team!

We hope everyone had a wonderful holiday and has a Happy New Year!